What does the instant loan impact my score on credit? It is contingent on a number of variables. If you’re trying to improve your credit score, it is possible through requesting a loan that has no history check. You must also be regularly paying them back to establish a track record …

Read More »Governor Khan to inaugurate conference on economics and development – The New Indian Express

By Express press service THIRUVANANTHAPURAM: Business leaders, senior management professionals and policymakers will share their views on current economic and development topics at TRIMA 2022, an annual management convention hosted by the Trivandrum Management Association (TMA). The event will take place at ‘O by Tamara’ on Friday. Governor Arif Mohammad …

Read More »Is it really the oldest tree in the world? Skeptics and proponents weigh in » Explorersweb

A tree called Alerce Milenario, located in Alerce Costero National Park in Chile, may be the oldest living organism in the world. Research by Jonathan Barichivich, a Chilean environmental scientist working in Paris, estimates that the conifer is over 5,000 years old. Barichivich drills into Barichivich holds a master’s degree …

Read More »Colorado State University student dies in plane crash in Nepal

A CSU student has died in a plane crash in Nepal, leaving a hole in the hearts of those who knew her. Rojina Shrestha, along with her mother, father and younger sister, were among 22 people killed in her home country of Nepal on May 29, according to media reports. …

Read More »Paddling to Hudson Bay | News, Sports, Jobs

Photo submitted by Tom Conroy Madison Williams paddles a kayak on the Minnesota River just northwest of New Ulm on Saturday. She is on a four-month, 1,700-mile solo trip from Minneapolis to Hudson Bay. She stopped in New Ulm for a day and a night and visited the members of …

Read More »Understanding the Correlates of Using CGM, with Lindsay Mayberry, PhD

The prospect of continuous glucose monitoring (CGM) has gone from science fiction to reality in less than a lifetime. Today, the role of CGMs in diabetes management is more pronounced than ever, but questions remain regarding the characteristics that make patients more likely to adopt and adhere to the use …

Read More »The high and rising cost of living in Florida

Gasoline. Races. Lease. Insurance. It has become more expensive to live in Florida – much more expensive. Overall, prices for all kinds of things are up nearly 9% from a year ago. Paychecks do not follow price increases. The inflation is here, and it’s squeezing Floridians, especially the elderly – …

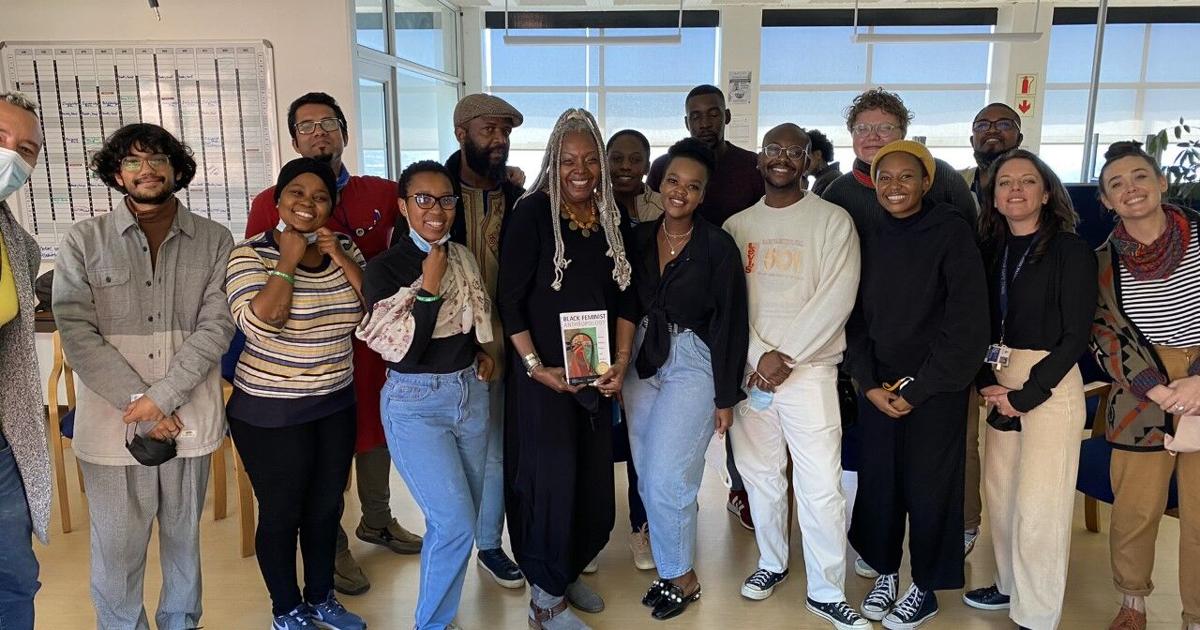

Read More »Dr. Irma McClauin South African Conference: Resistance and Radical Re-imagination | New

Bonke Sonjani (he/him) Bonke Sonjani is currently pursuing a Masters in Heritage Studies at the University of the Witwatersrand. He is also a trainee archivist at the GALA Queer Archives where he is interested in homosexual student protests in South Africa. Dr Irma McClaurin recently presented a guest lecture with …

Read More »Newark raises entry-level teacher salaries to $62,000 to address pandemic-worsened staffing shortages

In an effort to address a years-long teacher shortage made worse by the coronavirus pandemic, Newark Public Schools will raise starting salaries by $8,000 this fall, or about 15%, the district and local union announced. . Raising the starting salary to $62,000 a year for entry-level teachers in the state’s …

Read More »K-State Concrete Canoe Team Area Local Students Head to Nationals

The K-State Concrete Canoe Team poses in front of their canoe, built on the Triton Trireme theme, at the Mid-America Student Symposium in Ames, Iowa, in May. Back row, left to right: Dalton Wilbrandt, faculty advisor Christopher Jones, Cody Meyer, Ben Garnmeister, Luke Vohs, Nathan Streeter, Lindsay Schupp, Isabelle McCann …

Read More »FD Schools Appoint Schares Acting Superintendent | News, Sports, Jobs

An acting superintendent for the Fort Dodge Community School District has been appointed. Dr. Denise Schares, an associate professor at the University of Northern Iowa, will take charge of schools at Fort Dodge beginning July 1. In late April, current superintendent Derrick Joel tendered his resignation from the school board. …

Read More »OnPoint Community Credit Union Celebrates Largest Branch Expansion Anniversary With Special Member Promotions

“Despite all the challenges facing our communities, we are proud to open 20 new locations and provide essential financial services,” said Robert Stuart, President and CEO, OnPoint Community Credit Union. “Access to financial services and in-person education is more important than ever as our communities continue to navigate an increasingly …

Read More »A wake-up call for public education

Placeholder while loading article actions A recent national analysis contained a deeply troubling finding that has sparked little public debate when it should cause outcry: nearly 1.3 million students have left public schools since the start of the pandemic. Most states have seen declining enrollment for two consecutive years. In …

Read More »Letter to the editor: Evidence and lack of evidence for… : Emergency Medicine News

Letter to the Editor Evidence and lack of evidence for ketamine doi: 10.1097/01.EEM.0000834188.88309.76 Metric Editor: My first reaction was that Blake Briggs, MD was going too far to defend one of his residents. (“Why are we still talking about ICP and ketamine?” REM. 2022;44[3]:27; https://bit.ly/35LANFe.) That …

Read More »The College of Charleston welcomes new staff members

The College of Charleston is delighted to welcome its newest staff members. They come to the College with an impressive amount of experience and enthusiasm – and they are all excited to put it all to good use within the CofC community! Please welcome these new colleagues (listed alphabetically below) …

Read More »An engineer faces a hearing on a Canadian bridge that collapsed hours after opening

A Canadian engineer will face a disciplinary hearing this month after a bridge he designed collapsed just hours after opening. The five-day hearing before a panel of the Association of Professional Engineers and Geoscientists of Saskatchewan (APEGS) Discipline Committee will begin on June 6. The panel will examine allegations that …

Read More »Shanghai set to end 2-month COVID-19 lockdown

BEIJING (AP) — Authorities in Shanghai announced on Wednesday they would take major steps to reopen China’s largest city after a two-month COVID-19 lockdown that strangled the national economy and largely locked down people. million people in their homes. Full bus and subway service will be restored, as will basic …

Read More »Roadmap for a literature review

By Prof. RA Seetha Bandara, Board Member of the Sri Lanka Economic Association (SLEA) This article is based on a presentation made on April 28 at the “Roadmap for Literature Review” webinar that coincided with the launch of the Sri Lanka Economic Association (SLEA) e-repository. …

Read More »Investigative Committee finds evidence of harassment against UR teacher

The Inquiry Committee has found partial evidence on allegations of sexual harassment by two students against Professor Bishnu Kumar Adhikary of the Institute of Education and Research (IER) at Rajshahi University (UK). The university administration, in a punitive action, suspended his four-year raise and promotion at the union’s 514th meeting …

Read More »Jim Beam column: Payday loan bill must be vetoed – American Press

Louisiana lawmakers have passed a payday loan bill that will only cause more debt problems for citizens who need the financial boost they can get elsewhere.metrocreativeconnection.com From time to time, Louisiana lawmakers have come to the aid of those who make so-called payday loans. Sen. Rick Ward, R-Port Allen, is …

Read More »Education experts worry about Queensland high school students dropping out of arts subjects over ATAR result

Eden Gray entered college this year with an impressive ATAR, earned in part with arts subjects in high school, but her path is shrinking as students turn to science subjects in the belief that they will graduate. ranking. Key points: Student enrollment has fallen by around 44% in arts subjects …

Read More »Brooke Teacher of Year, others recognized by the board | News, Sports, Jobs

A WINNING COMBINATION – Tom Bane, far right, Brooke County Teacher of the Year, was recognized along with members of the Brooke High School chapter of SKILLS USA for their outstanding performance in the West Virginia SKILLS USA competition. Along with Bane, far left, who was named …

Read More »We cut our bills by £2,376

JUST welcoming twin babies into the world, paramedic Samuel Crowe and his partner Clare Holmes were finding it harder than ever to keep up with the bills. But after The Sun intervened – with the help of the comparison site MoneySuperMarket.com – the couple have been told they can cut …

Read More »Terracon Appoints Martin Reyes Director of Geotechnical Group

Terracon, a leading provider of environmental, facilities, geotechnical and materials services, has appointed Martin Reyes Group Manager of Geotechnical Services in its Pharr office. Courtesy Image – Advertising – Texas Border Affairs Pharr, Texas — Terracon, a leading provider of environmental, facilities, geotechnical and materials services, has appointed Martin Reyes …

Read More »Four UAMS Professors Receive 2022 Provost’s Innovator Awards

Enlarge image The recipients are Lisa Brents, Ph.D., Lyle Burdine, MD, Ph.D., Craig Forrest, Ph.D. and Gresham Richter, MD May 26, 2022 | The University of Arkansas for Medical Sciences (UAMS) announced that four UAMS professors were the recipients of Provost’s Innovator Awards. Lisa Brents, Ph.D. The awards were established …

Read More »Should you turn to credit cards if you can’t pay the bills?

Image source: Getty Images Credit cards can cover bills, but you’ll need to decide if using them to pay for expenses is a good idea. Key points Sometimes it is difficult to cover bills for living expenses. If you have available credit on your credit cards, it may be tempting …

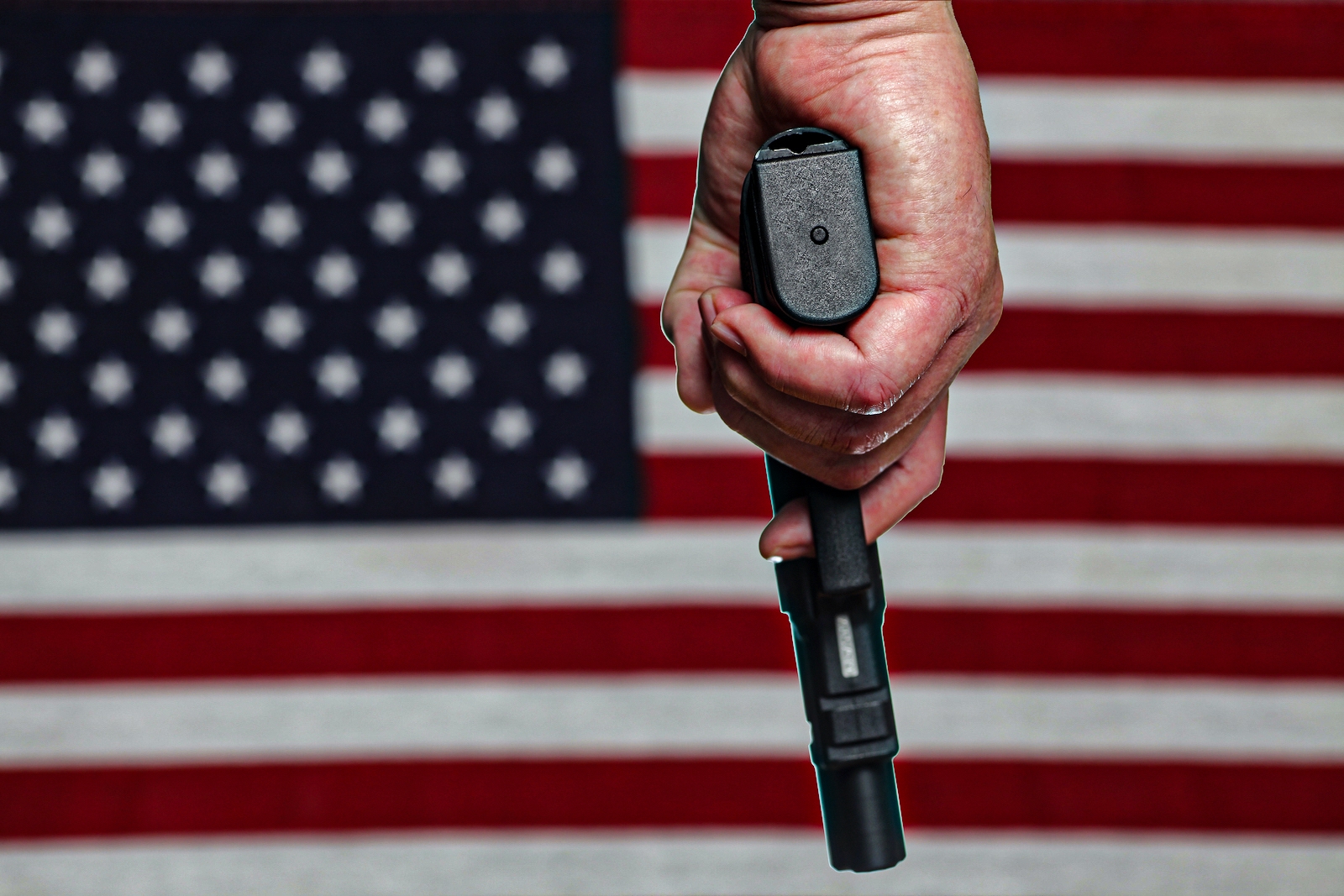

Read More »The Economy of Tolerable Massacres: The Uvalde Shootout

Societies tend to generate their own economies of tolerable cruelty and injustice. Poverty, for example, will be permitted as long as a sufficient number of individuals benefit from it. To some extent, crime and violence can thrive. In the United States, the economy of tolerable slaughter, carried out by military-grade …

Read More »Third grader, 3 fourth graders, 2 teachers among those killed at Uvalde Elementary School

Victims shot and killed at a Texas elementary school on Tuesday include 19 children – at least three of whom were fourth graders – and two teachers trying to protect them, relatives told media. Students and educators were days away from the end of the school year when they were …

Read More »UMass Amherst Receives Second Prize in NSF Taking Action: COVID-19 Diversity, Equity, and Inclusion Challenge: UMass Amherst

For its efforts to support faculty during the pandemic, UMass Amherst received second place in the National Science Foundation’s Faculty STEM category. Taking action: Diversity, equity and inclusion challenge in relation to COVID-19. Picture Led by Provost John McCarthy and Joya Misra and Laurel Smith-Doerr of the UMass ADVANCE program, …

Read More »26 students begin the Rural Fellows experience | Nebraska today

Twenty-six students begin their 10-week internships in 16 communities across Nebraska on May 24. They are the new cohort of Rural Fellows, an experiential learning program organized by the Nebraska Rural Prosperity Initiative of the Institute of Agriculture and Natural Resources. These students will work with mentors and leaders in …

Read More »Take your research to the next level

Body of the review The Auburn University Libraries Savvy Researcher Boot Camp is a one-day event, featuring workshops led by faculty and staff from Auburn University Libraries, Academic Writing, Academic Support, and QMER. Whether you want to locate scholarly sources, write a literature review, manage citations or data, or publish …

Read More »Hecht Wins 2022 Edgar M. Carlson Award

Gustavus Adolphus College Professor of Psychological Sciences, Dr. Lauren Hecht, was named the 2022 recipient of the Edgar M. Carlson Award for Distinguished Teaching during the College’s commencement ceremony on Saturday, May 21. The award is the College’s highest honor for teaching excellence. “In graduate school, after a long, fortuitous …

Read More »CC Slow Pitch League opens tonight – Monday Sports Wrap

High school In high school baseball today…• Houghton plays Jeffers.• Calumet goes to Iron Mountain.• Hancock welcomes Ontonagon.• L’Anse visits Lake Linden-Hubbell. In softball today…• Houghton visits Negaunee.• Hancock welcomes Westwood.• Voyages from Lake Linden-Hubbell to Gogebic.• L’Anse goes to Ironwood. At golf…• The Ontonagon Invitational will be played today. …

Read More »Wesleyan Celebrates Class of 2022 at 190th Launch

Early 2022 On a joyful day marked by ritual and ceremony, Wesleyan University bid farewell to the accomplished class of 2022 at its 190th launch, which took place on Sunday, May 22 on Denison Terrace. “I’m extremely excited. I was ready for this day,” said Amia Hagan ’22. “College is …

Read More »The country will not accept jobless growth

I find it hard to believe that 31 years have passed since the trumpet sounded for the first time on a change in economic policy: the devaluation of the rupee on July 1, 1991. It was a dramatic, disruptive gesture, and denounced vehemently. The opposition was so vehement that PV …

Read More »Dees steps down as dean of KSU to return to teaching | News, Sports, Jobs

Morning Paper/Deanne Johnson Dr. David Dees, dean of Kent State University’s Columbiana County campuses in Salem and East Liverpool, delivered his final commencement address earlier this week after deciding to step down and return to class on the Kent campus. SALEM — Helping students find those …

Read More »Estimation of childhood cancer incidence, prevalence, mortality and registration (0-14 years) in the WHO Eastern Mediterranean Region: an analysis of GLOBOCAN 2020 data

Background There is little evidence on the burden of childhood cancer in the WHO Eastern Mediterranean Region (EMR). Our aim was to provide an estimate of the burden of childhood cancer in the EMR, to examine the relationship between age-standardized mortality rate and income level (gross domestic product [GDP] per …

Read More »DVIDS – News – Crew of Coast Guard Cutter Hickory hold change of command ceremony in Homer, Alaska

HOMER, Alaska – The crew of the Coast Guard Cutter Hickory held a change of command ceremony at Pioneer Pier in Homer on Thursday. Rear Adm. Nathan A. Moore presided over the ceremony, where Cmdr. Jeannette M. Greene transferred command of the Coast Guard Cutter Hickory to Lt. Cmdr. Shea …

Read More »Alexander Cohen promoted to associate professor at Clarkson University

Clarkson University President Tony Collins announced that Alexander Cohen has been promoted from assistant professor to associate professor of political science on the teaching track in the School of Arts and Sciences. Cohen came to Clarkson in 2019. He previously served as assistant professor, program director and associate dean at …

Read More »Democrats grow desperate as economy falters

00:30 Republican “Replacement Theory” (22 mins)“We don’t have the economy on our side as Democrats,” Donny Deutsch said yesterday on MSNBC. “So you have to scare… people.” How do Democrats hope to do this? They tout the Republican “replacement theory,” claiming that Tucker Carlson and the Republican Party intend to …

Read More »Spizzler Reviews – Leading Earwax Removal Tool or Cheap Scam?

Since the ears play an important role in life, it is essential to keep them clean. The ear has three different parts. These parts include the outer, middle and inner, which convert sound into electrical impulses sent to the brain. The human ear protects itself with a natural waxy compound …

Read More »International Symposium on Advances in Blockchain (ISBA) 2022, the cosmic ray of the future of blockchain shines on Singapore

Get instant alerts when news breaks on your stocks. Claim your one week free trial for StreetInsider Premium here. Singapore, Singapore–(Newsfile Corp. – May 19, 2022) – The International Symposium on Blockchain Advancements (ISBA) will debut in Singapore, from 1st at 2n/a December 2022. Organized exclusively by ParallelChain Lab, ISBA …

Read More »Park seeks Hawaiian immersion teacher | News, Sports, Jobs

Teachers study the landscape at Hosmer Grove Lookout in Haleakala National Park. NPS picture Maui News Haleakala National Park is seeking a K-12 Hawaiian Immersion Instructor to participate in the “Teacher-Ranger-Teacher-Program” this summer. The selected teacher will spend between four and six weeks in the park …

Read More »Columbia student-athletes win prizes on campus

History links NEW YORK– A total of 21 Columbia student-athletes won various awards on the Columbia University campus during Kickoff Week 2022. “Each year, our student-athletes truly shine on the Columbia University campus by earning many of the university’s highest honors and honors,” said Campbell …

Read More »Breakthrough discovery could speed up computer processors simply by conducting more heat

Scientists have demonstrated a new material that conducts heat 150% more efficiently than conventional materials used in advanced chip technologies. The device – an ultra-thin silicon nanowire – could enable smaller, faster microelectronics with heat transfer efficiency that surpasses current technologies. Electronic devices powered by microchips that dissipate heat efficiently …

Read More »Federal Reserve Bank of Dallas welcomes new leader

Send your company’s North Texas senior executive hires and promotions to Kelsey Vanderschoot at [email protected] Federal Reserve Bank of Dallas Lori Logan, President and CEO Lori Logan After a nine-month search, the Federal Reserve Bank of Dallas has found a successor to former executive Rob Kaplan, who served as chairman …

Read More »Accuracy of a surface-based fusion method when integrating digital models and cone-beam CT scans with metal artifacts

This retrospective study was reviewed and approved by the Institutional Review Board of Bundang Hospital, Seoul National University (B-1911/576-105) and the Institutional Review Board of Columbia University -British (H19-03765). A total of 20 class III skeletal adult patients (7 males and 13 females; age, 21.7 ± 4.0 years) were included, …

Read More »Catholic Charities Appeal partners with Phillies for 9th Annual Catholic Charities Night at Citizens Bank Park – Delco Times

PHILADELPHIA — The Catholic Charities Appeal joins forces with the Philadelphia Phillies for its 9th annual “CCA Night with the Phillies” at Citizens Bank Park, Philadelphia on Thursday, June 30. The game, Philadelphia Phillies vs. Atlanta Braves, will start at 6:17 p.m.A portion of the proceeds from all tickets sold …

Read More »Reviews | In shootouts like Buffalo, hate isn’t the root cause

Placeholder while loading article actions James Densley is a professor of criminal justice at Metro State University. Jillian Peterson is an associate professor of criminology at Hamline University. Together they run the project on violence and are the authors of “The Violence Project: How to Stop an Epidemic of Mass …

Read More »“Political economy, not education focus, behind education policy” | Special report

Jthe Sunday news (TNS): You have been an active critic of the SNC. Can you provide some context for this policy for the lay reader? Dr. Ayesha Razzaque (AR): The genesis of the CNS is clear. When former Prime Minister Imran Khan inaugurated the SNC last September, he described it …

Read More »3 years into KIPP’s teacher pipeline plan, students are thriving

NEW ORLEANS (AP) — Twelve years ago, Alyana Jefferson was a kindergarten student in Cherelyn Poe’s KIPP Central City class, learning to read and do basic math. Now a senior at Booker T. Washington High School, Jefferson has a different role in the same class: she helps teach Poe’s students, …

Read More »Sustainability Awards Recognize Six People Who Have Made a Substantial Impact | University time

On April 22, six members of the Pitt community were honored with Pitt Sustainability Award. Launched in 2015, the awards recognize Pitt faculty, staff, students, and groups who are making a substantial impact in one or more of the three areas of sustainability: stewardship, exploration, community, and culture. Sustainability Award …

Read More »A new non-human primate model of desiccating stress-induced dry eye

Animals Twelve female rhesus macaques (Mr Mulatta) aged 4–5 years were used in these experiments. Monkeys had free access to drinking water and were fed monkey food (12% calories from fat, 18% calories from protein, and 70% calories from carbohydrates; 200-300 g/day ). In addition, a daily ration of additional …

Read More »Local businesses gathered at the local job fair to find employees

Work Force Solutions of East Texas brought together several East Texas companies to attract new employees. TYLER, Texas – If you’re driving around Tyler, it’s hard to miss those “help wanted” signs. Dozens of East Texas businesses gathered today for a job fair in hopes of attracting new employees. “We’re …

Read More »Can you get a jobless loan? Here’s what you need to know

Getting a loan can help you in many ways when you are in a tough financial situation, however, for some getting a loan is not as easy as it is for others. Many people who need a loan cannot get a good deal because of their credit score or even …

Read More »Kim Bishop obtains an MFA at UTSA 30 years after the BFA | UTSA today | UTSA

After earning her teaching certificate in 2003, Bishop taught art from grades three through six at Del Valle. She then taught second grade at Seguin before moving into secondary education, first at Seguin High School, then at Brackenridge and Jefferson High Schools in San Antonio. Bishop retired from Jefferson High …

Read More »Engineering Design Certification Launched at BHS | Local News

BATESVILLE — The Batesville Community Education Foundation has added another program to give Batesville High School students an edge over their peers. Thanks to a grant from BCEF, BHS students enrolled in Lead the Way project engineering courses will now have the opportunity to obtain an engineering design software user …

Read More »Examination of a forewarned future in Ukraine

At the start of Russian President Vladimir Putin’s invasion of Ukraine, colleagues from cultural institutions elsewhere in Europe began contacting contemporary art curator Vasyl Cherepanyn, asking if he was organizing or designing new projects. in response to the crisis. Normally, such inquiries would be understandable to Cherepanyn, director of the …

Read More »Lawmakers reach budget deal

House Appropriations Committee Chairwoman Rep. Mary Hooper, D-Montpelier, said Monday that lawmakers have delivered on their promise to support the most vulnerable Vermonters during the pandemic. File photo by Glenn Russell/VTDigger House and Senate lawmakers settled into place Monday on a key piece of the legislative jigsaw as they raced …

Read More »Ole Miss student athletes receive diplomas in early spring

History links OXFORD, Miss. – A total of 98 current and former Rebel student-athletes walked across the stage with diplomas in hand at the Spring Commencement Ceremonies spread throughout the weekend at the Sandy and John Black Pavilion at Ole Miss. The student-athletes, along with their families, …

Read More »The 10 best and worst states for working mothers in 2022, according to a new report

Since the onset of the Covid-19 pandemic, women taking on work and childcare responsibilities have suffered adverse effects on their careers. Recent research by the US Census Bureau, based on information from the Current population surveyfound that about 10 million American mothers living with school-aged children were not actively working …

Read More »Attorney General Josh Shapiro and State Representative Austin Davis stop in Williamsport | News, Sports, Jobs

State District Attorney Josh Shapiro speaks Saturday in Williamsport. MARK MARONEY/Sun Gazette State Attorney General Josh Shapiro, currently running for governor, and State Representative Austin Davis, who is seeking to become lieutenant governor, stopped in Williamsport on Saturday ahead of the May 17 primary to ask …

Read More »Meet MC’s new teacher, Ms. Galvan – The Caravan

Ms. Alexandra Galvan is Mt. Carmel’s newest addition to the faculty. She teaches Spanish but is also an assistant art therapist working in the South Shore and South Chicago neighborhoods. Ms. Galvan hails from St. Bede the Venerable Catholic Parish, where she grew up in a Spanish-speaking family. At the …

Read More »Two faculty members named Emeritus Professors

Kenneth J. Sufka (left), professor of psychology and pharmacology, and Robert Van Ness, Bruce Moore Chair in Finance, have been named the university’s Distinguished Professors. OXFORD, Mississippi — Two respected University of Mississippi professors with a combined 50 years of teaching, research and service have been named professors emeritus by …

Read More »Meet the MBA class of 2023: Luca Marini, HEC Paris

“Passionate, multi-faceted character who doesn’t yet know what to do when I grow up.” Hometown: Salerno, Italy Fun fact about yourself: When I started my career abroad, my level of English was so bad that people couldn’t understand me well. Among other stories, I remember confusing the verb “print” with …

Read More »Accuracy of death certificates from diabetes, dementia and cancer in Australia: a population-based cohort study | BMC Public Health

Four notable findings emerged in the present study: (1) susceptibility to diabetes, dementia, and cancer being recorded as the underlying cause of death was low but improved significantly if contributing causes of death were taken into account; (2) women with dementia who died before 2006 were less likely to have …

Read More »Celebrating our RIT College of Science retirees for 2021-2022 | college of science

Congratulations to our 2021-2022 College of Science retirees! As faculty or staff, our retirees have played an essential role in the success of our college. Like all RIT retirees, they continue to be part of the Tiger family and have access to many things on campus, including: RIT Academic and …

Read More »Stanford gets $1 billion for John Doerr climate change school

NEW YORK (AP) — Stanford University will launch a new school focused on climate change thanks to a $1.1 billion gift from billionaire venture capitalist John Doerr and his wife, Ann, the university announced tuesday. The gift, one of the largest donations to an American institute of higher learning, will …

Read More »AI search is a trash fire and Google is holding the matches

The world of AI research is in shambles. From academics prioritizing easy-to-monetize programs over innovation, to the Silicon Valley elite using the threat of job loss to encourage business-friendly assumptions, the system is a broken mess. And Google deserves the lion’s share of the blame. how it started There were …

Read More »UCF Professor Receives NSF Grant to Fund Groundbreaking Friction Research

Masahiro Ishigami, an associate professor of physics, was recently awarded a two-year, $332,552 grant from the US National Science Foundation in recognition of the potential of his work to fill a knowledge gap in tribology – the study of friction, lubrication and wear. According to a 2017 U.S. Department of …

Read More »The Vanderbilt Hustler | ‘A death sentence’: Vanderbilt professor sues university over in-person teaching tenure

Associate professor of philosophy Idit Dobbs-Weinstein has filed a civil lawsuit court case against Vanderbilt on March 15, who claims she suffered “unlawful disability-related discrimination” because of the university’s imposed in-person instruction policies for faculty. She claims she has the right to teach remotely as a disability accommodation under the …

Read More »LA Riot: Moving forward 30 years later with determination and HOPE | News

Three decades ago, Los Angeles erupted in some of the worst urban violence America has ever seen. People were furious that the LAPD officers who were filmed beating Rodney King would not be punished. It was a fuse that ignited a keg of gunpowder, the effects of which still reverberate …

Read More »Deputy Minister highlights fiscal tools stabilizing economy

imaginechina Xu Hongcai, Vice Minister of Finance China has taken proactive fiscal measures on several fronts this year in the areas of tax and fee reductions, public budget spending and bond issuance to stabilize the economy and ensure the well-being of the people. population, said a senior official. “Tax and …

Read More »2022 SUNY Chancellor’s Award for Student Excellence Winners Announced

Jules KA Hoepting (left) and Anders Lewis with President Stephen H. Kolision Jr. Two brilliant SUNY Fredonia seniors – Jules KA Hoepting and Anders Lewis – received the 2022 SUNY Chancellor’s Award for Student Excellence at a ceremony April 26 in Saratoga Springs. A system-wide award, it recognizes students for …

Read More »12 under 40: Daniel Conley | Local News

From an early age, Daniel Conley knew he wanted to get involved in construction. “I’ve always loved construction, even as a young kid, seeing backhoes digging was really cool,” Conley said. “I had Tonka trucks and a whole fleet of equipment.” Fast forward to college and the Rose-Hulman Institute of …

Read More »A same-sex marriage kings Calvin University

In December, officials at Calvin University, a Christian school in Grand Rapids, Mich., voted to renew a two-year teaching contract for Joe Kuilema, an associate professor of sociology. Eight days later, the provost received photos of Kuilema officiating a same-sex wedding. One of the women in the Oct. 15, 2021, …

Read More »Wisconsin is paying for a practice that some say is legalized loan sharking

MILWAUKEE—A new study shows that Wisconsin residents pay some of the highest rates in the country for payday loans. There are payday loan companies all over the country. There are approximately 23,000 of these lenders open right now. This is almost double the amount of McDonald’s open Across the country. …

Read More »Market Brief: There’s Good News in Fed Rate Hikes

The first four months of 2022 have been very difficult for investors. Stocks and bonds are posting steep losses, largely due to the Federal Reserve shifting gears to a much, much more aggressive path to raising interest rates to calm the economy and bring inflation under control . The Federal …

Read More »Immune-Related Skin Adverse Events in Taiwanese Cancer Patients Receiving Immune Checkpoint Inhibitors Linked to Survival Benefit

Dermatological toxicities are the most common AEIR with the overall incidence of dermatological toxicities of all grades in patients treated for advanced melanoma in clinical trials were 34-42% in nivolumab, 43.5-58.5 % in ipilimumab and 43.2–46.3% in pembrolizumab, with a higher incidence (58.5–71.5%) in patients treated with a combination of …

Read More »Southlake, Texas teachers urged to sign ‘non-disparagement’ agreements

Seven months after teachers at the Carroll Independent School District in Southlake, Texas, went public with concerns about a trustee’s advice to balance Holocaust books with titles that show “opposing” perspectives, District employees discovered this week that a new clause had been added to their annual employment contracts, listed under …

Read More »SU Announces 2022-23 Remembrance Scholars

Get the latest news from Syracuse delivered straight to your inbox. Subscribe to our newsletter here. Syracuse University announced the names of the 35 2022-23 Remembrance Scholars Thursday in a university press release. The scholarship honors the 35 students killed in the bombing of Pan Am Flight 103 in 1998, …

Read More »MuseumTalks is hosting a paleontology conference on April 29 with Celina Suarez

Photo submitted Interested in paleontology? Looking for your next read? So join us for both at MuseumTalks: Fossils at 6 p.m. Friday, April 29 at Pearl’s Books, an independent bookstore here in Fayetteville! Celina Suarez, associate professor of geosciences at the U of A, will …

Read More »K12 Inc, Connections Academy, Mosaica Education – Ripon College Days

the “Virtual Schools Market” The 2022 Business Report contains global analysis and estimation of various market related factors which are incredibly crucial for better decision making. A competitive analysis has been carried out in this industry analysis report for the major players in the market which helps companies to take …

Read More »At 62, Atlanta man returns to college tuition-free thanks to state seniors program

ATLANTA, Ga. (CBS46) — An Atlanta man is returning to college at the ripe old age of 62, and a state program gives him a golden opportunity. When Jeff Criswell turns 64 in two years, he won’t be considering retirement. Instead, hopes to start a new career as a high …

Read More »Algorithm designed to help scientists optimize their reading list

If you want to be a scientist, you’re going to have to do a ground of reading. Science is a business focused on building and sharing knowledge. Researchers publish articles detailing their discoveries, breakthroughs and innovations in order to share these revelations with their colleagues. And there is millions of …

Read More »Central Florida District secretary tipped to lead FDOT | WNDB

Sean Mooney Daytona Beach, Florida – There’s a new face at the helm of the Florida Department of Transportation, and he might be familiar to some in Volusia County. His name is Jared Losthe was secretary of FDOT District 5, which encompasses much of central Florida, including Daytona Beach and …

Read More »Harouna Maïga, Ph.D. Wins Horace T. Morse Award for Outstanding Contributions to Undergraduate Teaching – Crookston Times

University of Minnesota Crookston Since 1965, the Horace T. Morse-Minnesota Alumni Association Award for Outstanding Contributions to Undergraduate Teaching has been awarded to a select group of teachers who reflect the University’s emphasis on the importance of high quality undergraduate education. Those who receive this award become members of the …

Read More »Unemployed, millions of Indians are leaving the labor market | Business and Economics News

The problem of job creation in India is turning into a greater threat: an increasing number of people are not even looking for work. Frustrated at not being able to find the right kind of jobs, millions of Indians, especially women, are dropping out of the workforce altogether, according to …

Read More »Dominic Artman, Lake Secondary School

NAME – Dominique Artmann RESIDENCE – uniontown AGE – 18 THE SCHOOL – Lake High School MPC- 4.48 COLLEGE CHOICE – Ohio State University PARENTS – Christopher and Jolene Artman DESCRIBE YOURSELF IN THREE WORDS – Persistent, resourceful, resilient. SCHOOL ACTIVITIES – Wrestling, Cross Country, Track, National Honor Society, GenYes …

Read More »first cohort of building technology program to graduate | Education

The beginning is always a time of celebration and new beginnings. This spring, four WVU Tech graduates will be the first to earn bachelor’s degrees in construction management, the first and only such degree in the state. Tristen Nesmith from Shady Spring, Ryan Perry from Kanawha Falls, Lucas Berg from …

Read More »League of Women Voters and Washburn professors will host a discussion on CRT

TOPEKA, Kan. (WIBW) – The League of Women Voters will host a presentation on Critical Race Theory at the Topeka Shawnee Co. Public Library with guest speakers hailing from Washburn University. Members of League of Women Voters of Topeka and Shawnee County say they will host a presentation on Critical …

Read More » Xing Wu

Xing Wu

/cloudfront-us-east-1.images.arcpublishing.com/gray/PBUNPPCXZNB7LO5EYU7AU37AKI.JPG)

/cloudfront-us-east-1.images.arcpublishing.com/gray/DW6E2BXBQFHIDEDUCM3Q5EQBBQ.jpg)